Stocks, bonds, mutual funds, etf’s, REIT’s, notes & the list can keep on going. These are all forms of passive investments that most Americans have in their portfolio. Of course the risk you are willing to take on as an investor depends on where you are at in life. At retirement age your portfolio might consist of low yield bonds & very little stocks. You might be looking to preserve the wealth that you created for your family over the last 30-40 years of hard work.

The Stock Market Breakdown

As I am sure you are aware the stock market is the #1 investment vehicle that individuals use to preserve & create more wealth for themselves & their family. Over the last century the stock market has averaged a return of roughly 10% annually. Now, that really sounds amazing… but what about the volatility?

Some days it is up 30% (exaggeration) and other days it can be down 20%. You own a share of a company that could drop drastically depending upon what is happening in the CEO’s personal life. The stock market reacts to both economical factors & also personal factors. If a company is lead by an unsteady CEO the stock price could drop & now your investment is worth significantly less.

From the other standpoint, the company could invent a new product… like the next iPhone. The stock price could 10x in a 2 year span & earn you an enormous return on your capital. You will be ecstatic with your market timing & brag to your friends & family.

My question for you is this, “Is the process repeatable?“.

Sure, you can study & learn all about how to invest in stocks, bonds, commodities & all the other items publicly traded. You can try day trading & either make significant returns or lose drastically. Or you can just invest via a 401k & let the money sit to season & grow over time. To be honest, there is no wrong way of doing it.

Real Estate Breakdown

First, let me answer what it actually means to invest passively in real estate.

Explanation: You will not be in charge of operating the property on a daily basis. You will receive monthly updates on the real estate investment & how the executive plan is coming along. Depending upon the hold time you can have you capital back in as little as 1 month, or up to 10 years. The hold time is solely dependent upon if your investment capital is being used to purchase a single family house or larger multifamily apartment building/commercial building. The Real estate investor will state this upfront in their offering memorandum.

Why Consider It an Option

Real estate is one of the most popular routes to create incredible wealth & large sums of passive income. If that punch line isn’t enough to bring you in, your investment is backed by a physical asset, that is secured below market value & that has tremendous upside potential. When we invest in Real estate it is through the purchase/rental/sale of single family homes and apartment buildings. All of our projects are secured anywhere between 40-70% of total market value.

Real Estate is “Real”

Unlike stocks or bonds you can physically touch & work on the property. If you want to increase the value of the property you make updates & earn a better ROI. Furthermore, in the case of a catastrophe you have insurance on the property to pay you back incase it were to burn down or completely flood. Will StateFarm allow you to take out insurance on your stock market investments?

Tax Advantages

Of course I always need to make the disclosure that I am not a tax professional or attorney so please speak with your CPA or attorney for more information. However, real estate has many tax benefits. As a passive investor in real estate some of these may or may not be applicable to you, so please speak with your CPA with further questions.

Real estate depreciation is an income tax deduction that allows a taxpayer to recover the cost or other basis of certain property placed into service by the investor. Depreciation is essentially a non-cash deduction that reduces the investor’s taxable income. Many investors refer to it as a “phantom” expense because they are not actually writing a check. It is merely the IRS allowing them to take a tax deduction based on the perceived decrease in the value of the real estate.

Real estate depreciation assumes that the rental property is actually declining over time as a result of wear and tear. But we know this is not typically the case. Not many other forms of investment offer comparable depreciation deductions. As a result of real estate depreciation, the investor may actually have cash flow from the property but may show a tax loss.

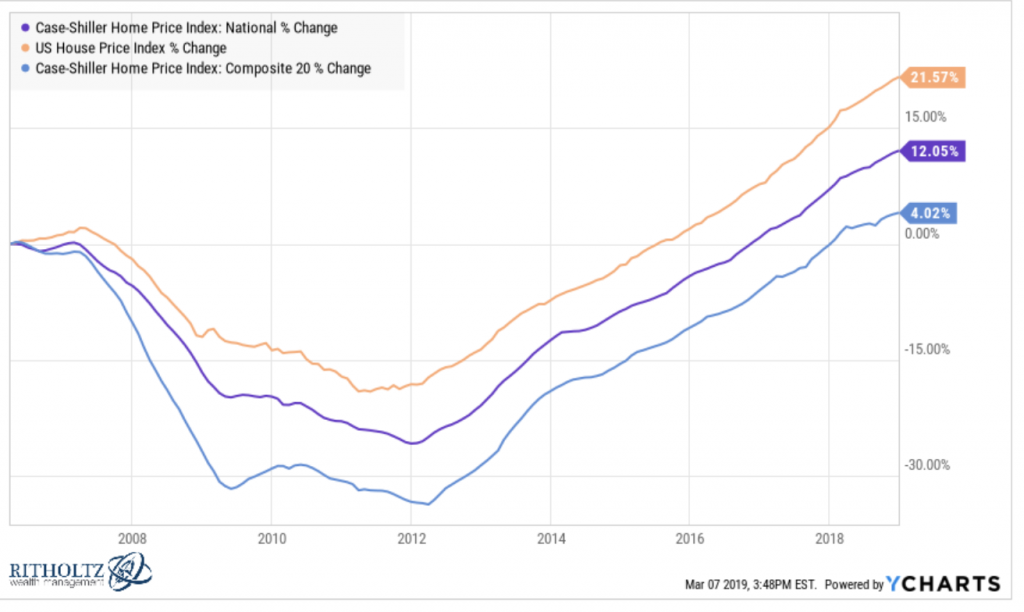

Volatility of Real Estate

Throughout history real estate values have gone up in value. However, during certain timeframes the market has dropped significantly & operators have lost considerable amounts of property. The most recent example of this was in the 2007-2010 time frame. In 2007 there was a false sense of hope in the market. Individuals were securing loans with little to no proof of income. People who could barely afford to purchase 1 house were buying 3-4 & taking advantage of the 0% down loans. Hindsight shows it was a recipe for disaster. But, since the housing crisis of 2008, the market has recovered & price points have superseded what they once were.

Other then the rare occurrence of a global housing crisis, normally real estate follows a 10 year trend. Values go up, then they compress (historically 10-15% in the Midwest) and then they go back up. It is a roller coaster effect, each time with values going higher than before.

However, with real estate it is extremely rare that the value of your property would fall 5-10% in a 1 day span. It is not like the stock market where you could wake up the next morning & see you now have a $44,000 loss in your portfolio. Of course with the volatility can come great rewards. But, I am not a fan of losing money so that is why I chose the safe & steady income of real estate. If a property is there on a Monday & I drive by it again on Friday, there is a very good chance that it is still worth the same amount. (Unless it Burns Down) The real estate market is a slow moving machine that creates enormous amounts of wealth over time. And that is why I choose it as my main investment vehicle.

You can also refer people who want to sell their houses and earn money.

One Last Thought

Let me ask you something…

If you would have bought 4-10 properties 20-25 years ago, do you think they would be worth more today?

How much more? $5,000 – $25,000 – $50,000?

The power of real estate is incredible & we would love to take you along on our journey. If you want to learn more about passively investing in real estate with us please fill out the form on our Contact Us page or send me an email investwisc@gmail.com