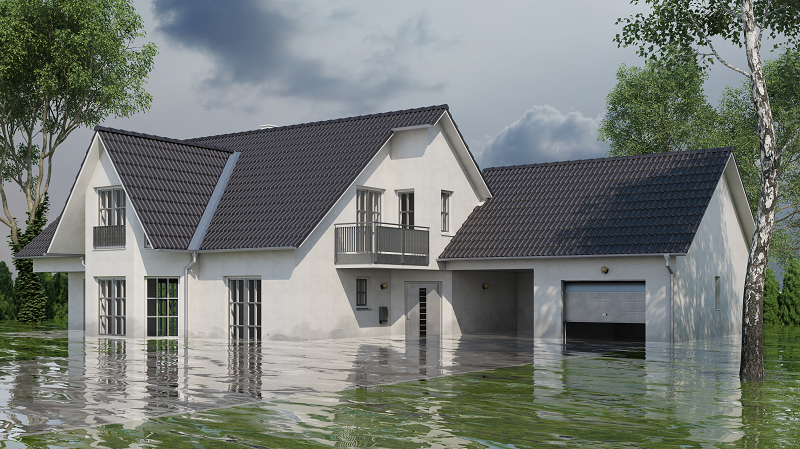

Homeowners can become overwhelmed by the damage caused by flooding. If you are thinking about selling a flooded house in Oshkosh, there are several things you should consider. If you are selling a flood damaged house, you might find it much more challenging than selling a home in pristine condition.

If you are lucky, the water damage to your home was caused by a burst pipe. You might not consider this lucky, but you can quickly fix the pipe and repair water damage, which does not present a risk for future floods.

On the other hand, selling your home becomes much trickier if the flood is natural because your home sits in a high-risk area of the floodplain. You will consider much more than the cost of selling a house that flooded. You must tell the buyers the risks, and the home is on the flood plain.

Can I sell my house without repairing the water damage? You might be asking yourself this question and get lucky and receive a cash sale offer that lets you walk away from a stressful situation. However, if you find yourself in a position where you must sell a flooded house in Oshkosh, we will discuss some things you should keep in mind.

Selling a Flood Damaged House

It can be challenging for homeowners who are selling a flood damaged house. Whether the water damage was caused by a natural disaster or broken water pipes, home sellers must keep this in mind when selling their flood-damaged houses to potential buyers.

You should consult a real estate agent with experience selling a flood-damaged house. A realtor will be able to recommend the best way to attract home buyers regardless of flood damage.

They may advise you to repair the damage before selling a flood damaged house. You can work with your flood insurance company to complete any flood damage clean-up. Flooding can cause significant damage to drywall, carpeting, and personal belongings and can cause contaminants and mold damage which are health risks.

Your insurance company and a FEMA (federal emergency management agency) inspector will assess the damage and recommend a plan for repairs. Clean-up must start immediately after the flood, and the flooded area should be cleared out and dried so you can assess the damage to the walls and flooring.

Depending on the timeframe, remediation of the flood damages might be as simple as putting in dehumidifiers. You should clean any standing water with a wet vacuum. It would be best if you never tried to hide water damage when selling a flooded house. Water damage will affect the market value of your home, and the cost of repairs will vary depending on the extent of flood damage.

If you don’t want the hassle of repairing your water-damaged house, you could consider a fair cash offer from a real estate investor. Often, they will offer a no-obligation cash offer for the home as-is. Investors have more resources to repair significant water damage and buy flood-damaged property to fix, flip, or use as a rental property.

Repairing a Flood Damaged House

You should contact your homeowner’s insurance if you are considering selling a flood-damaged house. Repairing damage caused by flooding is time sensitive. Flood damages are evident on your flooring and furniture, but mold can start to grow in as little as 24 hours. Mold growth is inevitable if you don’t clean up the water quickly and adequately.

Professionals should remove mold in a house from flood damage. Repairing any mold issues before selling a home damaged by flooding is vital. Mold can cause health problems, and a person exposed to mold spores will experience allergic symptoms. You should document any mold repair that you did to show prospective buyers.

In addition to mold issues, flooding can cause significant damage to the structure of your home. You will need to hire a contractor that has experience with flood damage. Typically, your insurance company will recommend a restoration company they work with. Certified technicians should check the electrical and HVAC systems.

The next step is to replace your flooring and the subfloor. Mold spores will multiply on any porous surface, so it is essential to remove any damp wood. Wood may seem dry on the outside, but it can be damp on the inside, leading to mold. The safest way to repair flood damage is to replace anything that might have gotten wet.

It would be best to open the walls to let the studs dry. The contractor should remove any drywall a foot above the water line to prevent mold growth. Wet insulation should also be removed and replaced when everything has dried out. Your contractor will use a moisture meter to determine when it is safe to start rebuilding.

Flood Zone Variances in Wisconsin

When selling a flooded house in Oshkosh, you must know Wisconsin’s flood zone variances and insurances. Floodplain management identifies high-risk areas for flooding, and specific insurance policies are designed to help flood-damaged homes.

A variance is the authorization for the construction or maintenance of structures by a community even though it goes against the terms of floodplain management requirements. These variances are rare because there is an increased risk to life and property.

Property owners must justify particular criteria to receive a variance. Even though a variance may be granted, property owners should consider the higher risk that their property will flood and the costly insurance premiums accompanying the variance.

The National Flood Insurance Program

FEMA, the federal emergency management agency, develops flood hazard maps used by communities, insurance agents, and realtors. Communities in Wisconsin that follow the floodplain management requirements can buy NFIP, a national flood insurance program.

Property owners will pay higher premiums for this type of insurance, but you will be protected in the case of flood damage.

Getting Elevation Certification

If you want to sell a house fast in Oshkosh, it is vital to acquire an elevation certification. Mortgage lenders often require elevation certification to prove that the property they are mortgaging is adequately elevated, and the proper elevation is one of the requirements of floodplain management regulations.

You will need an elevation certificate to buy flood insurance. If there is no elevation certificate on file for the property, you will have to contact the manager of the floodplain manager. If you encounter problems, you can hire a land surveyor, professional engineer, or an authorized architect to provide elevation certificates.

Flood Zone Declaration To Potential Buyers

Wisconsin law requires sellers to disclose if their property is in the floodplain. However, no law states a homeowner must tell if there has been any flood damage to the property or if there is a requirement for flood insurance.

Homesellers will have to disclose if there is a variance on their property and the additional flood insurance needed for ownership of the property. You could sweeten the deal by offering to transfer your existing flood insurance to the buyer and covering the insurance costs until the renewal date might close the sale of your flooded house.

Reducing Flooding Risk

It would help if you did everything you could to protect yourself against the devastation flooding can cause. You should buy flood insurance even if your property is in a low-risk area. Many factors can cause flood damage, and it is impossible to prevent all of them so that flood insurance will protect you from the unexpected.

You can do some things to help prevent or minimize flood damage to your property. Property owners should elevate their HVAC systems, water heaters, and other utilities as high as possible. They should install check valves in their sewer traps to prevent the water from backing up.

You should never store personal items on the floor of your basement. You should add shelving to store your belongings and never store electronics in an area that could sustain water damage.

You should add barriers around your basement to prevent flood water from seeping into your home. Basement walls should be sealed and watertight.

It would be wise to have an emergency plan in case of a flood. You will need a place to go while your flood damage is being investigated. Most flood-damaged houses require extensive repair, so it might be a long-term plan.

Conclusion

If you are a stressed homeowner facing costly repairs to your flood damaged house, remember some companies can give you a cash offer today for your home. You won’t have to worry about repairing the water damage and dealing with your insurance company.

When selling a flood damaged house, remember you will face some challenges. You will have to repair the flood damage and attract buyers, which becomes more complicated when your house is in a high-risk flood area.

If you are selling a house that needs a lot of work, remember that we buy houses Wisconsin homeowners are trying to sell.

Your success will depend on the extent of the damage, the risk of future flooding, and your willingness to negotiate. Flooding will significantly lower the value of your house.